Bank of New Zealand (BNZ) is one of New Zealand’s big four banks and has been operating in the country since the first office was opened in Auckland in October 1861 followed shortly after by the first branch in Dunedin in December 1861. The bank operates a variety of financial services covering retail, business and institutional banking and employs over 5,000 people in New Zealand. In 1992 the bank was purchased by the National Australia Bank and has since then operated as a subsidiary, but it retains local governance with a New Zealand board of directors.

As of June 2022, BNZ is the second largest bank operating in New Zealand, with a market share of 19.1%.

Source: wikipedia.org/BNZ

Woke Rating

We rate BNZ as very woke, especially with it’s excessive cultural virtue signalling and integrating Te ao Māori (the Māori world) into everything. BNZ is not the most woke bank in New Zealand but it’s not without its share of wokeness. Despite this wokeness, BNZ supports some very positive community programs through its partnerships with charities such as Good Shepherd NZ, Habitat for Humanity and others.

Woke Summary

- Virtue Signalling – BNZ indulges in excessive Cultural Virtue Signalling and Tokenism. Te ao Māori (the Māori world) is fully integrated into BNZ. BNZ wants to be “the bank for Māori.”

- Gender Ideology & LGBTQ – BNZ is Rainbow Tick Certified, has a Rainbow Inclusion strategy, and celebrates Pride Month.

- Diversity Equity Inclusion (DEI) – has DEI policies and applies gender-based recruitment targets. Te ao Māori (the Māori world) is fully integrated into BNZ.

- Climate Change – supports the Paris Agreement, and has emissions reduction targets. BNZ is a member of the UN’s Net Zero Banking Alliance.

Woke Policies

Wokeness and virtue signalling distracts a company from its core business, which is to make a profit for shareholders while delivering excellent, affordable products and services to its customers. Businesses should not be distracted from this core purpose, otherwise there will be unnecessary costs which are ultimately passed onto consumers. Woke ideologies are typically unfriendly towards the traditional family unit.

Below are some woke policies and initiatives from BNZ…

Virtue Signalling

BNZ indulges in excessive cultural virtue signalling and tokenism. A Maori worldview is embedded throughout the organisation. BNZ has a strategy of integrating te ao Māori (the Māori world) into its business practices, policies, products and services.

Maori spirituality is part of the banks strategy and culture, making reference to “honouring Ngā atua (the gods)” and “Ranginui – the Sky Father, and Papatūānuku – the Earth Mother.”

BNZ wants to be “the bank for Māori.”

“Our Māori strategy aims to build a strong wharenui (large house), built on three pou or pillars. If we build our pou correctly and with strength, we will earn the right to be the bank for Māori.”

BNZ’s Maori recruitment drive

“By 2030 we have a target that at every employment level 15% of colleagues will identify as Māori.”

Source: 2023 BNZ Sustainable Futures Report. and www.bnz.co.nz/about-us

The word Māori occurs 120 times in their 2023 BNZ Sustainable Futures Report. Whereas the word family/families appears only 3 times.

Gender Ideology & LGBTQ+

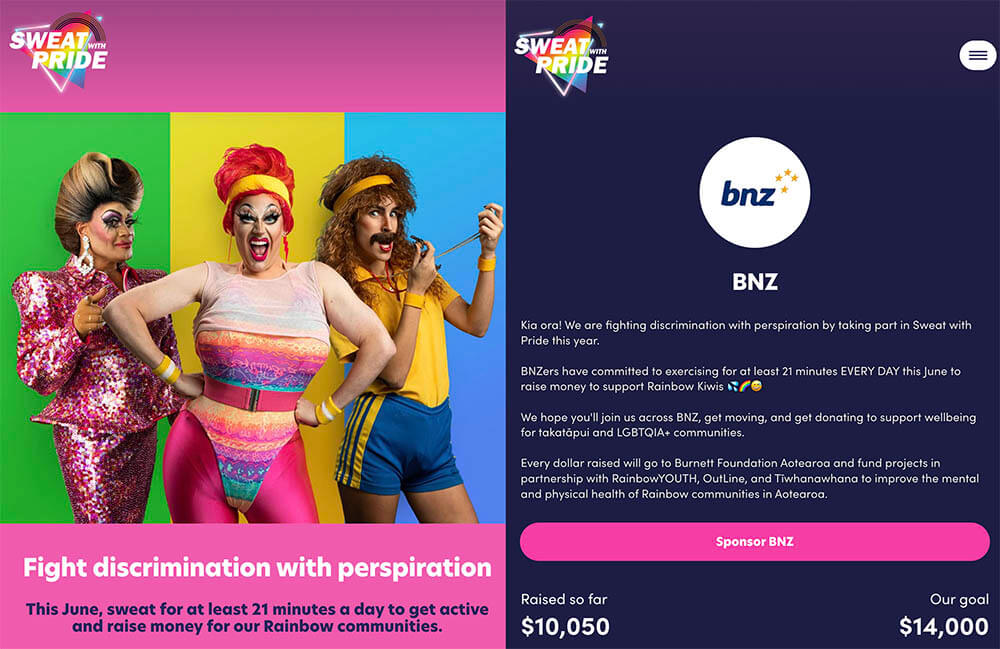

BNZ is Rainbow Tick Certified, has a Rainbow Inclusion Strategy, has its own Rainbow network group, and celebrates Pride Month.

BNZ is involved in fundraising for Rainbow communities.

“This year our people took part in Sweat with Pride – helping to fight discrimination with perspiration and getting their bodies moving for the month of June. BNZ fundraising contribution for Rainbow communities was the second highest amount raised by business this year. We also held initiatives for pride month, trans awareness week, and non-binary awareness week, and more than 280 of our people, including 73 people leaders, completed both of the Rainbow Tick training modules (Rainbow Tick is a certification program for organisations who accept and value people by embracing the diversity of sexual and gender identities). ”

Source: 2023 BNZ Sustainable Futures Report.

**********************************************

Diversity, Equity and Inclusion (DEI)

BNZ is fully committed to diversity, equity and inclusion (DEI). It has DEI policies and applies gender recruitment targets.

BNZ has a documented DEI strategy (and policies) in its 2023 BNZ Sustainable Futures Report.

BNZ’s Let’s Kōrero program is full of wokeness …

”Our Let’s Kōrero podcast shares stories from our people on topics such as neurodiversity at work and gender-inclusive language. Created by our Culture, Diversity, and Inclusion Team, Let’s Kōrero was designed to identify unconscious bias in the workplace and explore identity, inclusion and belonging through storytelling. We have so far created 14 episodes. As a result of this series, we’ve seen many of our teams come together, using the podcast to drive further discussion and awareness.”

Source: 2023 BNZ Sustainable Futures Report.

Embedding a Māori Worldview: “Embedding the level of connection and capability of our people, customers and communities with te ao Māori including te reo Māori.”

“Our Māori strategy aims to build a strong wharenui (large house), built on three pou or pillars. If we build our pou correctly and with strength, we will earn the right to be the bank for Māori.

By 2030 we have a target that at every employment level 15% of colleagues will identify as Māori.”

The word Māori occurs 120 times in their 2023 BNZ Sustainable Futures Report.

Climate Change

BNZ supports the Paris Agreement, Agendas 2030 and 2050, and has emissions reduction targets. BNZ is a member of the United Nations-convened Net-Zero Banking Alliance, and the Climate Leaders Coalition.

BNZ has already begun setting emissions reduction targets for its business and farming customers. Eventually BNZ (along with our other major banks) will refuse lending to business and farming customers that do not meet the emissions reduction targets imposed by the bank. Ultimately this will force certain customers and farms out of business altogether.

“Two pillars of BNZ’s Sustainability Strategy are: Kaitiakitanga – to accelerate the transition to a net zero emission economy, and Manaakitanga – to grow the long-term social, cultural, and financial wellbeing of New Zealanders.”

Some of BNZ’s goals include:

- Accelerate the just transition to a net zero emissions economy

- $10b in sustainable finance by 2025

- 50% of BNZ SME customers to reduce emissions by 2023

- Set 2030 decarbonisation targets for priority sectors in 2023

- Committed to exit lending to coal mining by 2030

- Transitioning our investment and lending portfolios to net zero emissions by 2050

“In May 2023, we published our first BNZ Net Zero Banking Alliance target disclosures for our priority sectors including; Dairy, Coal, Oil and Gas, and Power generation.”

Source: www.bnz.co.nz/assets/bnz/about-us/PDFs/2023-Sustainable-Futures-Report.pdf

Like other banks, BNZ has set emissions targets for farms it lends to. BNZ has already set a target of cutting by 11 percent the climate impact-per-kilo of food produced by its farmer customers, by 2030.

Positive Policies & Activities

BNZ’s corporate responsibility initiatives are focused on financial and digital inclusion, and getting more New Zealanders into warm, dry, resilient homes. Read more here www.bnz.co.nz/about-us/sustainability/people-and-communities

Disrupting predatory lending

No and low interest loans and advances through partnerships. BNZ has a target to provide $50 million for no and low interest loans and advances by 2024. Since 2014, BNZ has delivered $17.8m against its commitment. BNZ delivers lending and advances through three key partnerships, aimed at helping people access essential products and services, and avoiding the pitfalls of resorting to high cost, predatory lenders. Good Shepherd NZ and BNZ now offering all Good Loans interest and fee free

Habitat for Humanity programme

$3.2 million of lending delivered through the Habitat for Humanity New Zealand Home Repair programme since 2019, helping get more New Zealanders into warm, dry, and resilient homes.

Boosting digital inclusion

Lifting digital skills means more New Zealanders will be able to fully participate in our economy, improving productivity and boosting our economy. BNZ is a founding member of the Digital Boost Alliance (a collaboration between business and government) and has made seven pledges to encourage digital transformation. These pledges support improved digital inclusion for our colleagues, our customers, and communities. The activities range from basic actions such as having accessible websites through to caring for some of our more vulnerable customers.

Parental leave

BNZ made changes to its parental leave benefits including boosting KiwiSaver contributions to 6% for the time eligible colleagues were on unpaid leave, extending the BNZ top up from 22 weeks to 26 weeks, and removing the requirement to be back at work for 12 months before a subsequent top up.

Volunteering

BNZ staff have two volunteer days to use each year, and BNZ partners with HelpTank to match volunteers with different opportunities around New Zealand.

Note – This page was updated as of 20th May 2024. Please contact us if you’ve discovered other relevant information about BNZ or other businesses pushing woke agendas. You should also contact us if you discover some positively woke-free businesses.